Solar-e

Redsigning an end-to-end customer journey

My role

Final UX bootcamp project, where I was one of two UX researchers and designers. The brief was to make improvements to the website of a independent energy consultancy to increase business leads.

Our approach was to discover, define, design, develop & deliver.

Constraints we soon discovered were that the business was in its early stages, with no current customers and unclear (and untested) backstage processes.

Interviews, personas and journey mapping were a joint effort. As an experienced web professional, I audited the current site architecture and content and tested proposed changes.

TIMELINE + OUTPUTS /

2.5 weeks to deliver personas, competitor review, future experience map, wireframes, initial concepts.

ROLE + RESPONSIBILITIES /

UX researcher / designer

- Discovery

- Synthesis

- Personas

- Journey mapping

- Website audit

- Ideation

TEAM

- 2 x UX Researcher / UX Designer

TOOLS

- Otter

- Miro

- Figma

- Photoshop

- Illustrator

Context

Australia leads the world in residential uptake of solar panels, around 20% of free-standing households. By the end of 2018, it had 1.96 million residential and 78,000 commercial and industrial rooftop solar systems. Yet as of June 2019 that was still less than 5% of the potential capacity (UNSW, 2019).

Solar-e is a new entrant to the industry, trying to tap into this huge potential market. An independent energy consultancy, they use analytics to help strata, businesses and corporations optimise solar investment.

The business problem — generating new business leads.

The user problem — overcoming complexity, uncertainty & perceived effort in procurement.

The solution — a redesigned customer journey to take the stress out of making an investment in a solar installation

Discovery

We started by trying to understand the business model to see where else we might add value. A business model canvas identified Solar-e’s value proposition as 'helping strata, small-to-medium businesses (SMEs) and corporations optimise their solar investment'.

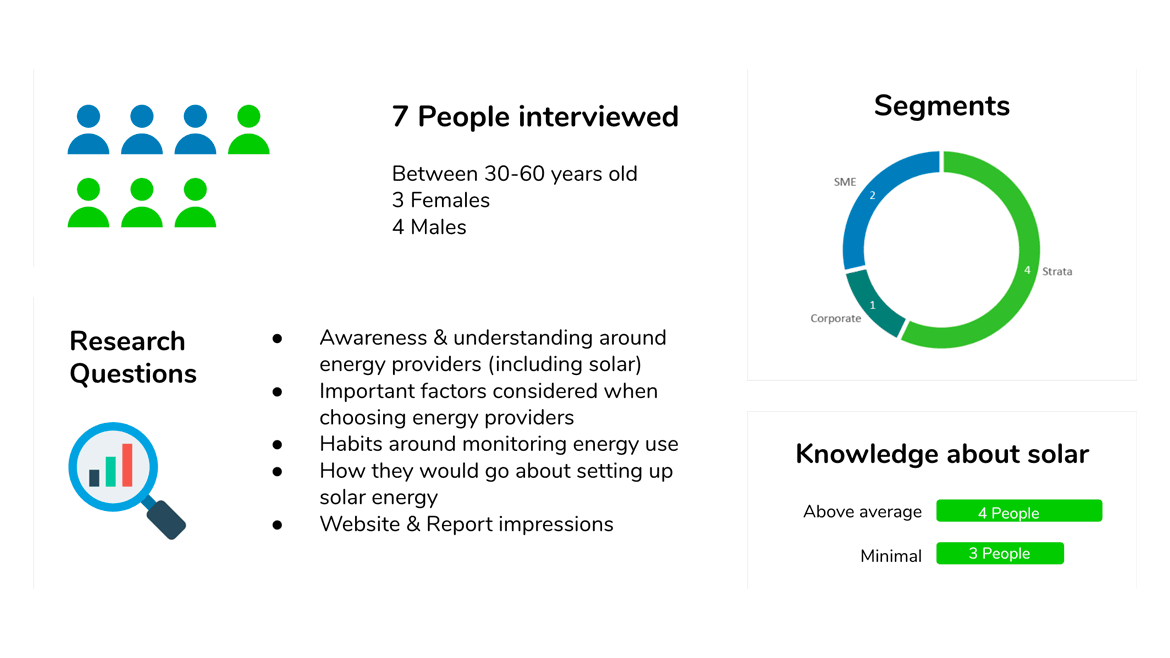

We interviewed seven people - two SME owners, a corporate facilities manager, a strata manager, a strata lawyer and two strata committee members - to get an idea of their knowledge of energy usage, how they assessed suppliers, and what they knew about solar energy.

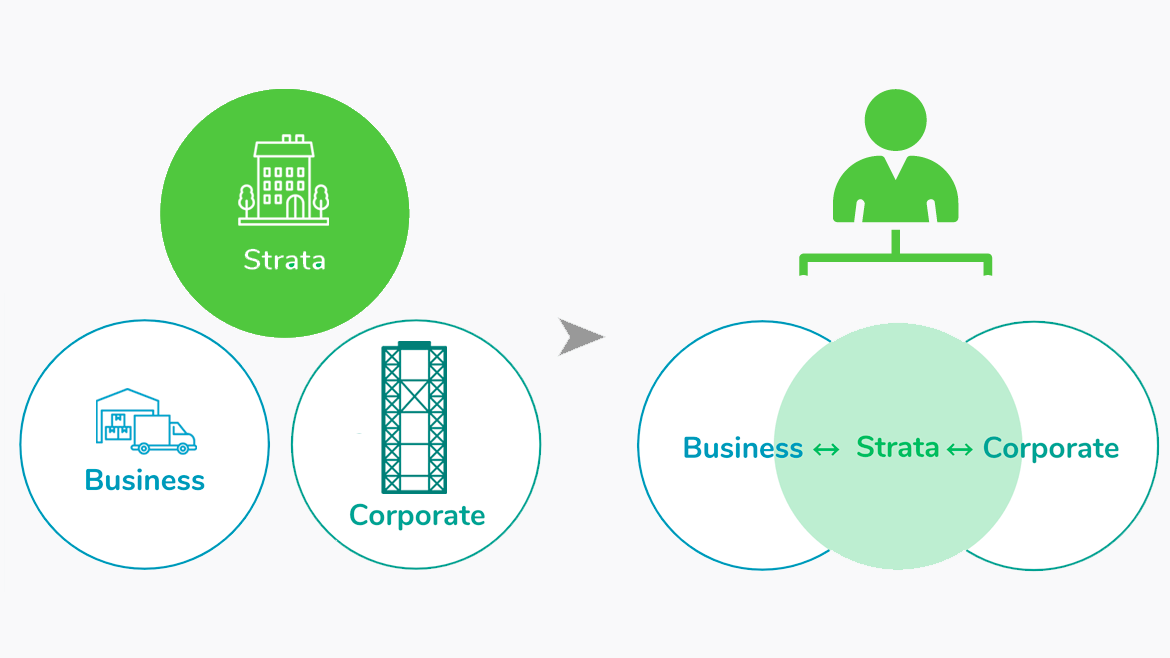

Initially, we thought strata only managed residential buildings, but commercial strata serve the SME and corporate markets too. Businesses had the same problem as residential customers - not owning roof spaces where solar panels could be installed. This meant they either:

- assumed it wasn't possible, or

- assumed it required complex negotiations with strata managers and paperwork.

Defining

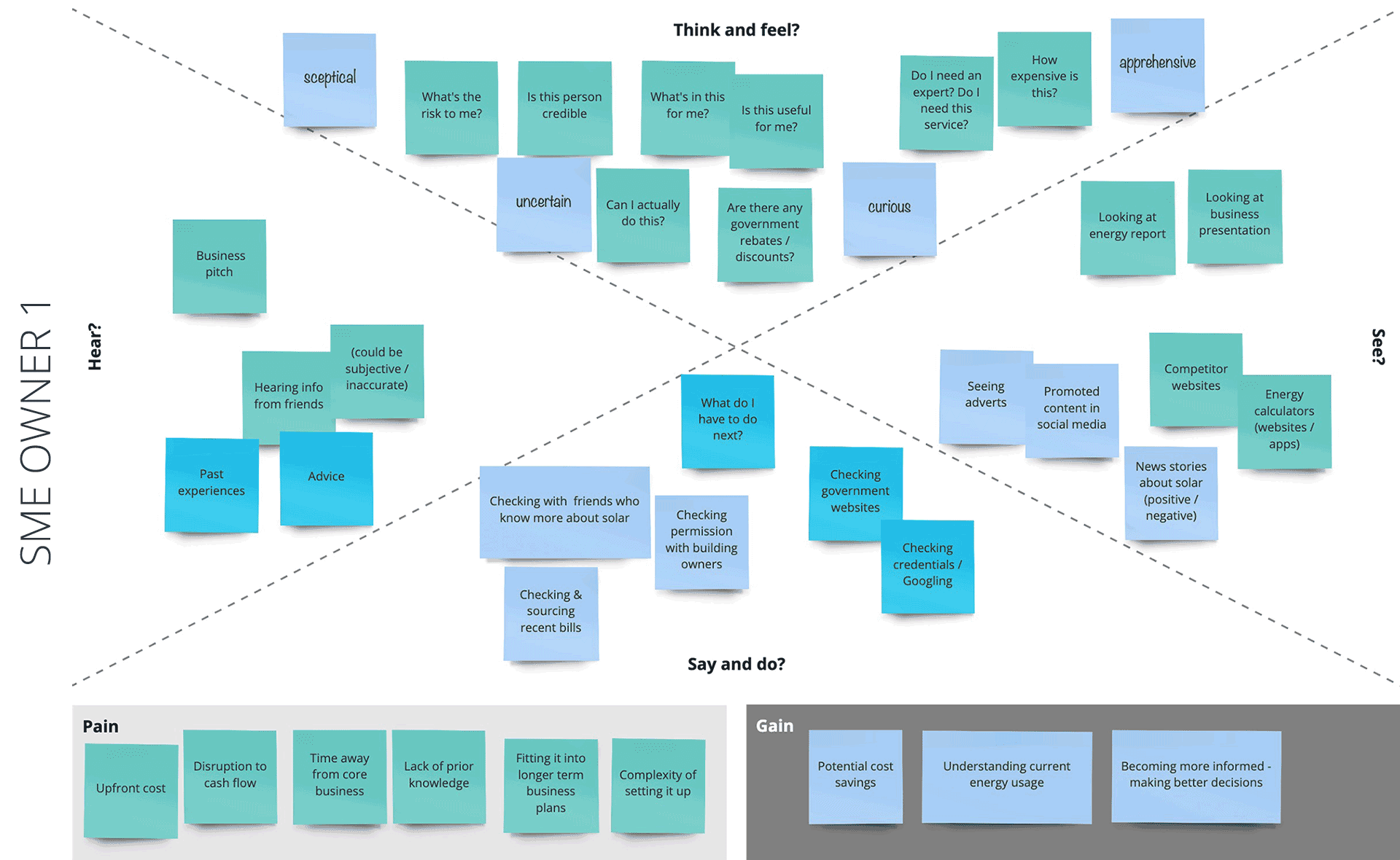

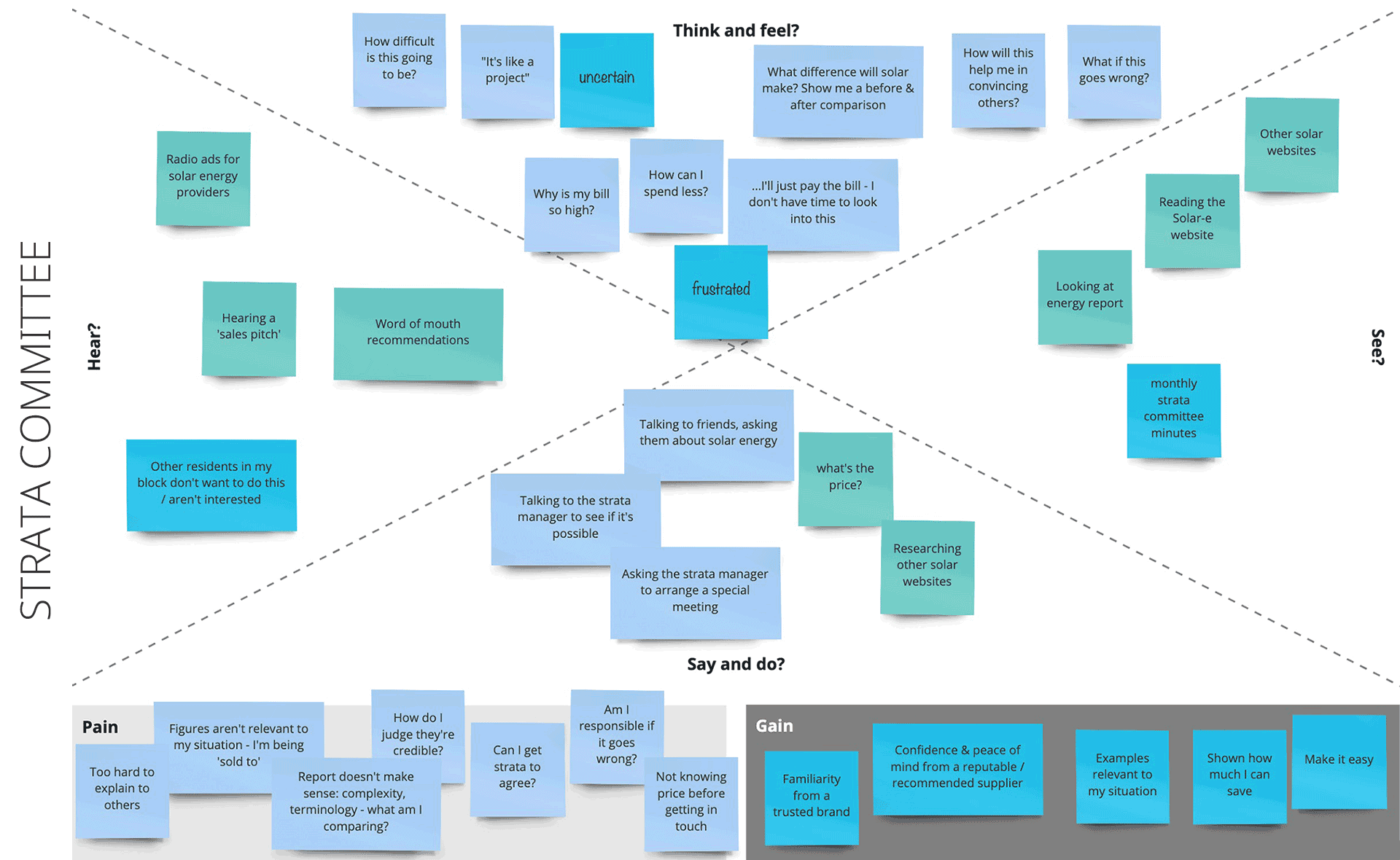

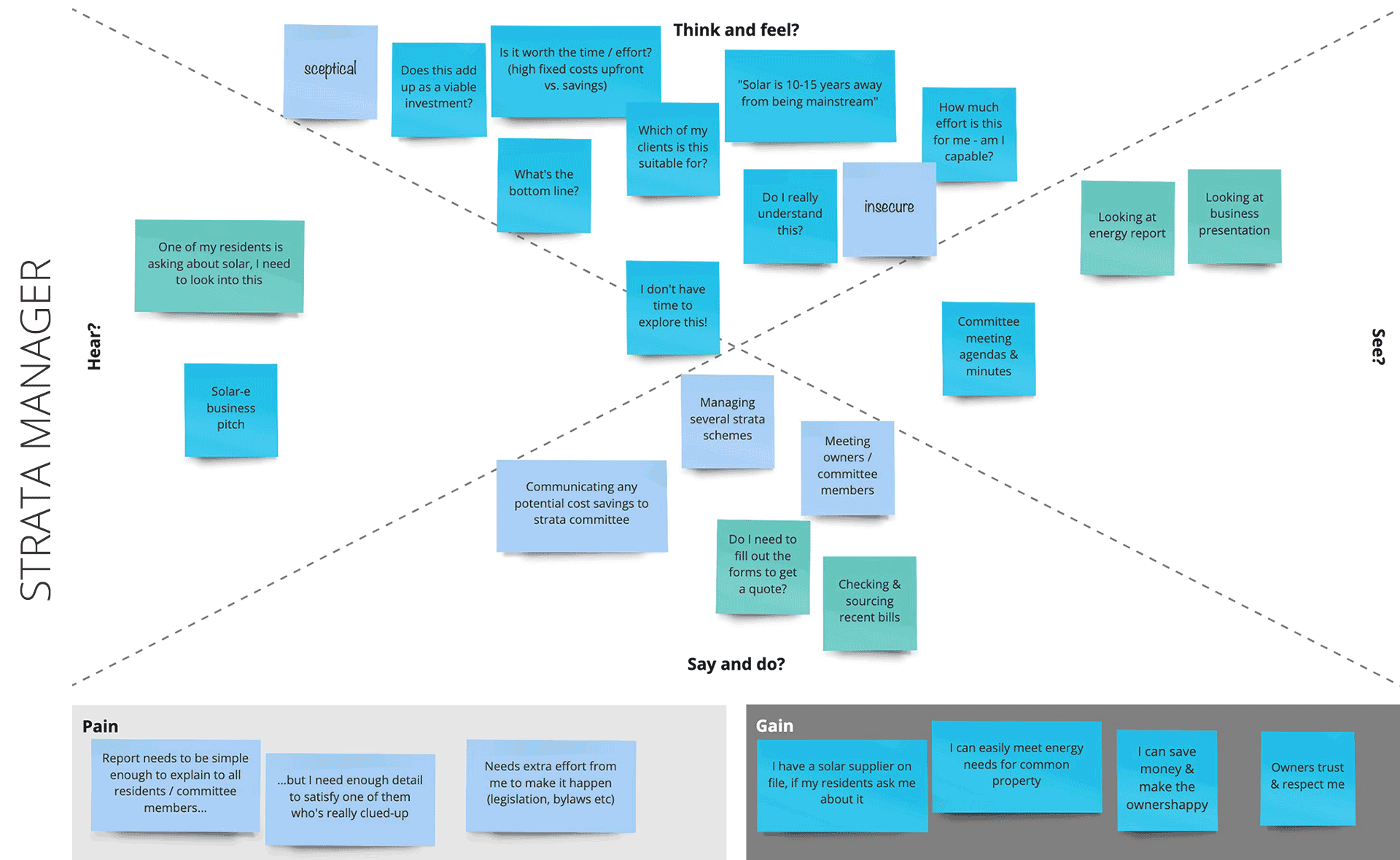

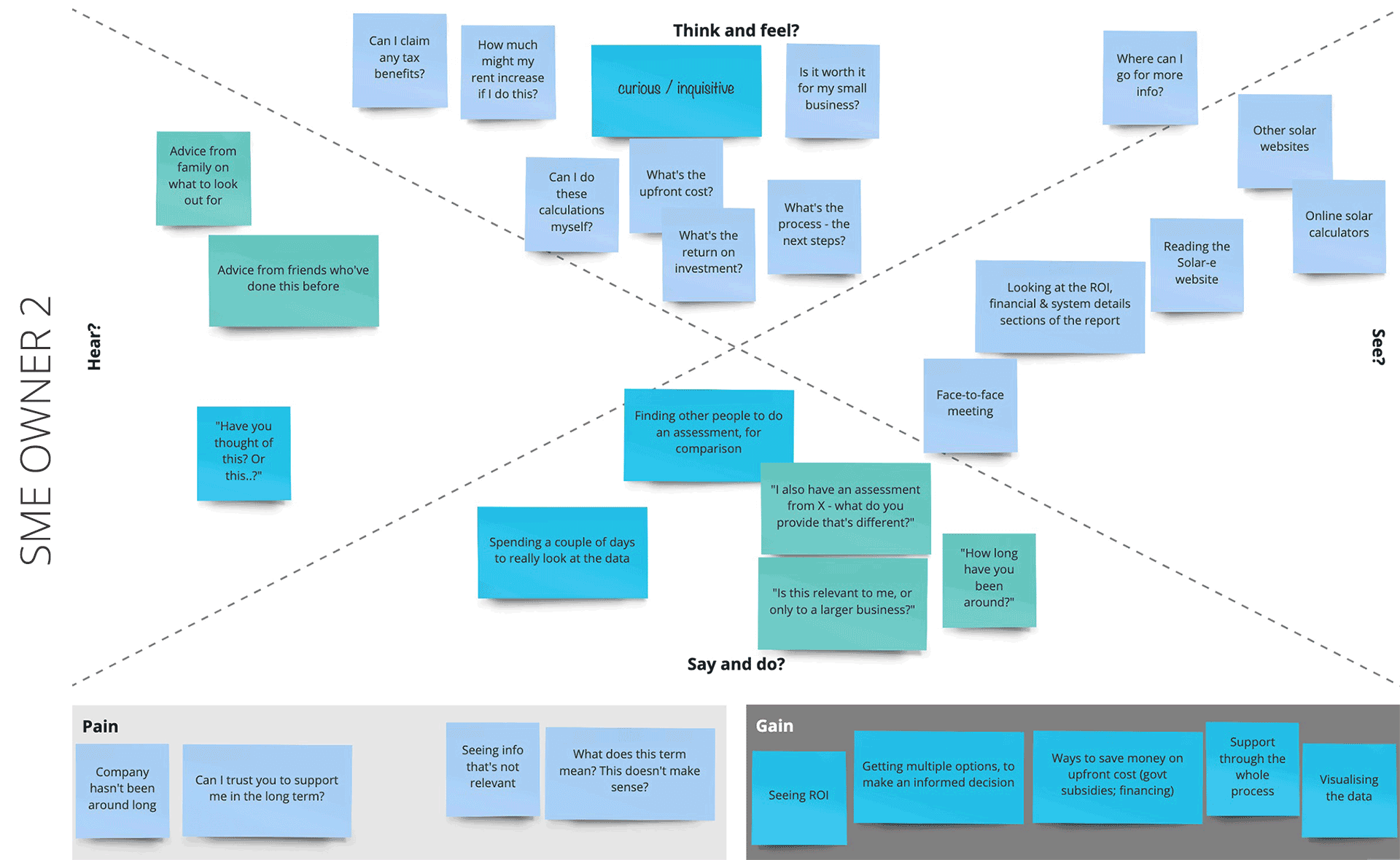

We used the interviews to make empathy maps for the two SME owners, the strata manager and a strata committee member, to work out their pain points in getting solar.

- Eligibility — this is key to even get started – if you can't answer the basic question "can I get solar?", everything else is irrelevant.

“Can I get solar? What’s the point if I can’t even do it”

- Credibility — solar takes over 3 years to pay off, plus a large upfront cost. People want to know their investment is safe, and they're in good hands after installation.

“If the inverter breaks, it won't cost me anything - they'll come & fix it”

- Cost — get this far, and the drivers become ‘what can I save’ and ‘how much will this cost? Is it worthwhile financially?'

“I want to know my return on investment”

- Effort — switching energy providers is already hard work. Including solar in the choice adds even more complexity.

At any point in this journey, users might bail out. The choice isn’t just between providers, there's also the choice to do nothing instead.

“It’s like a project, more complicated than the usual electricity connection”

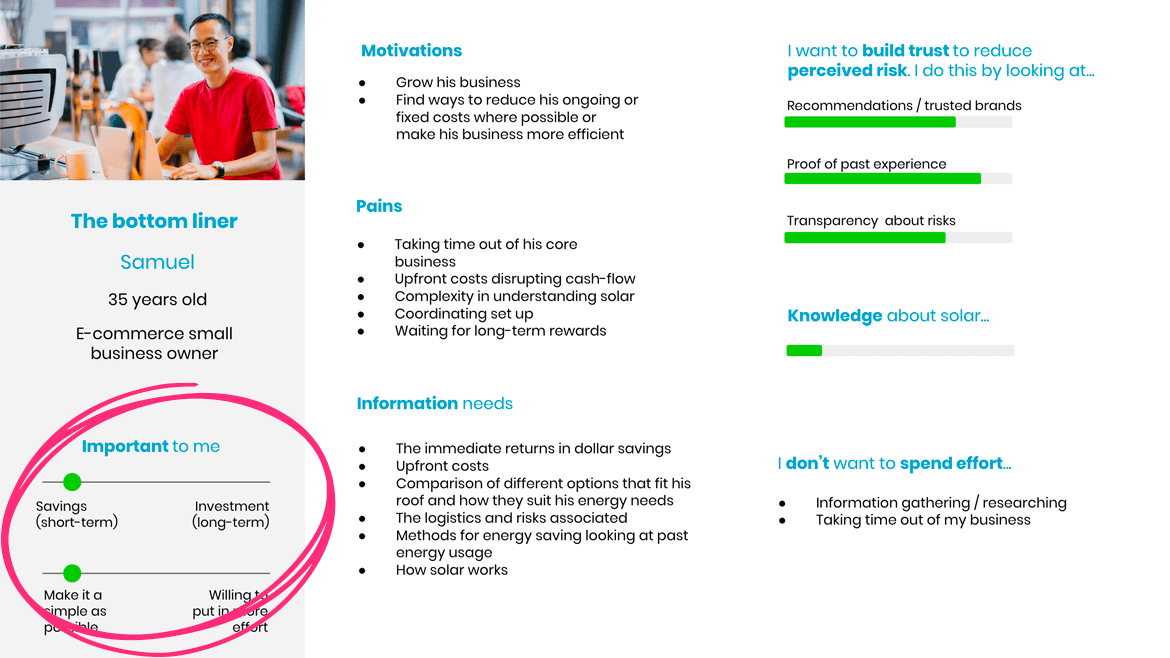

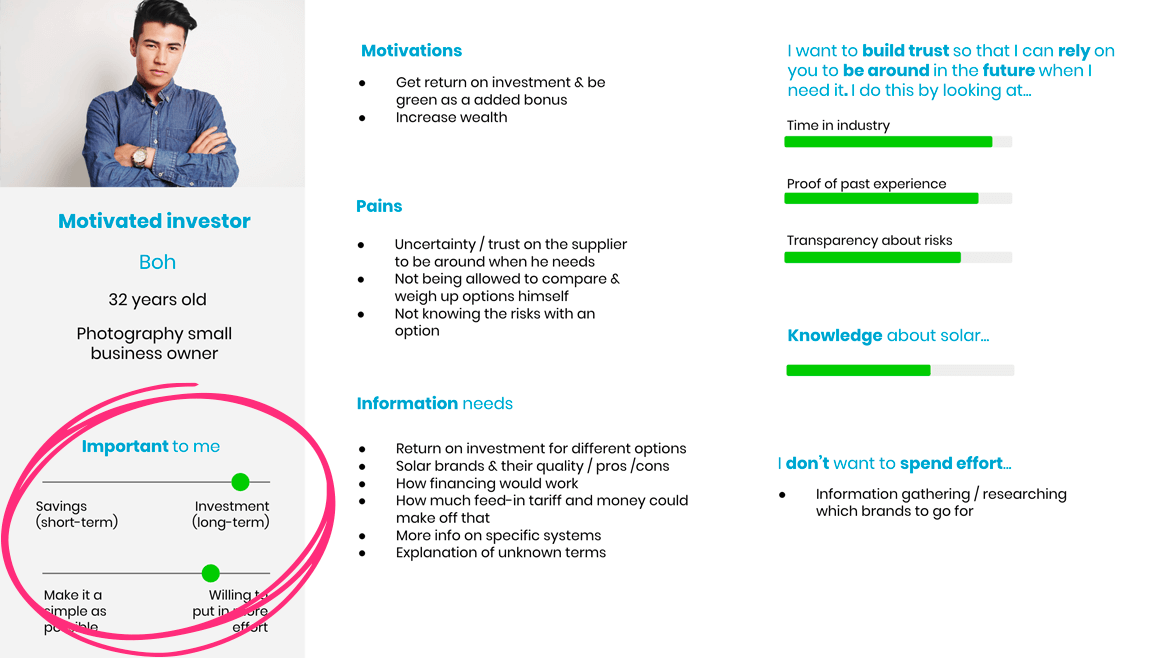

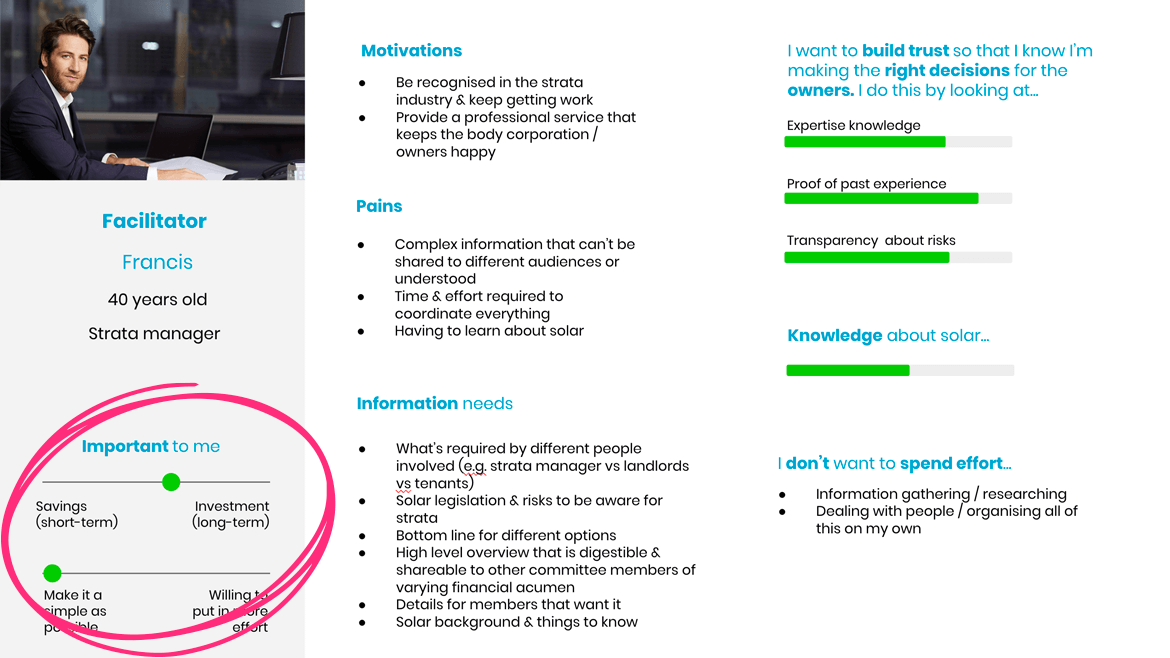

While the decision-making journey was the same, people diverged in what “cost” meant to them. This difference informed three personas:

- The bottom liner — seeks immediate savings, with short-medium term impact on cash-flow

- The motivated investor — invests in long-term savings, for potentially a bigger return

- The facilitator — works for a third party: a strata manager saving a property owner money, or an employee reducing costs for a business.

Design

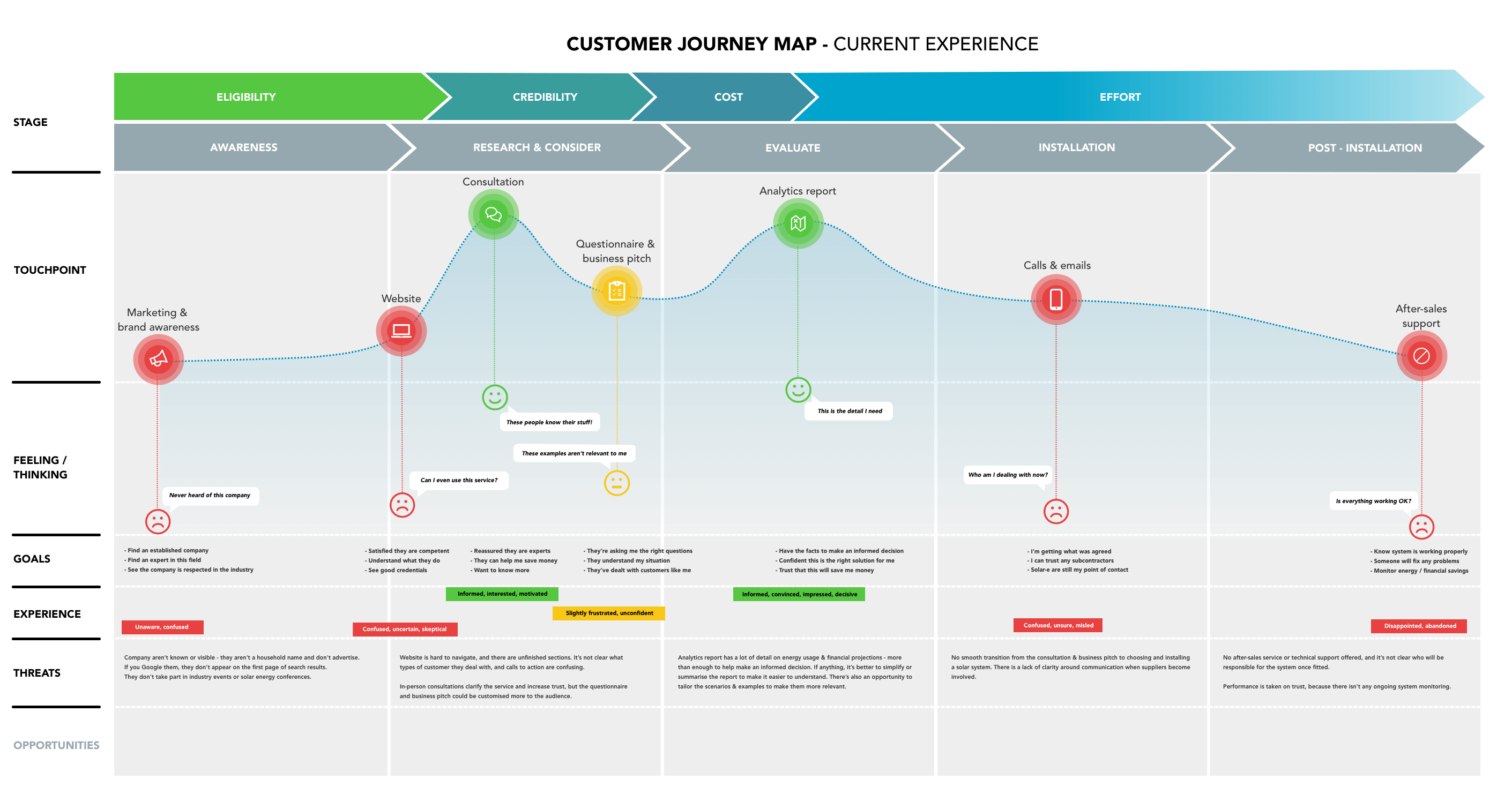

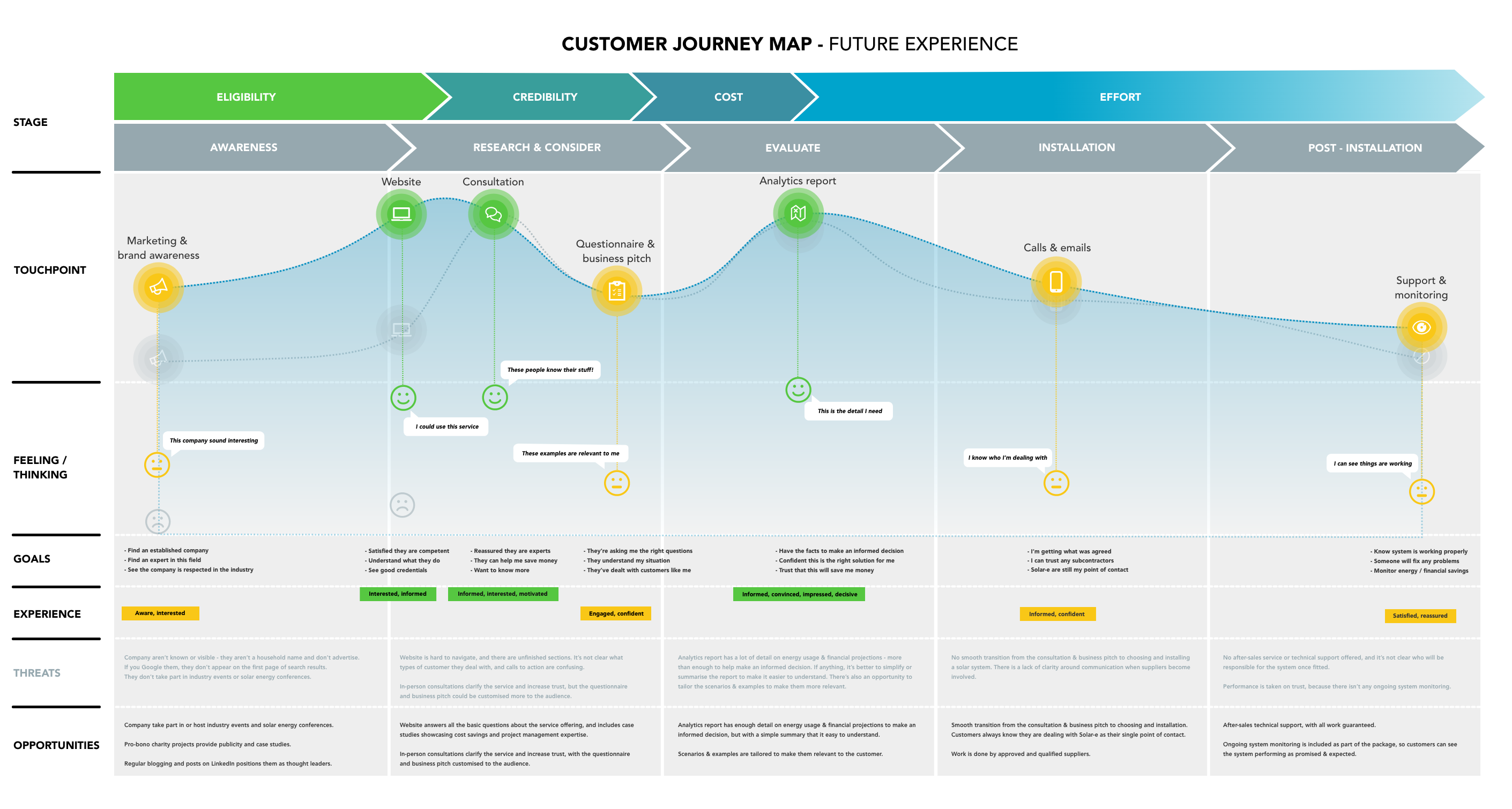

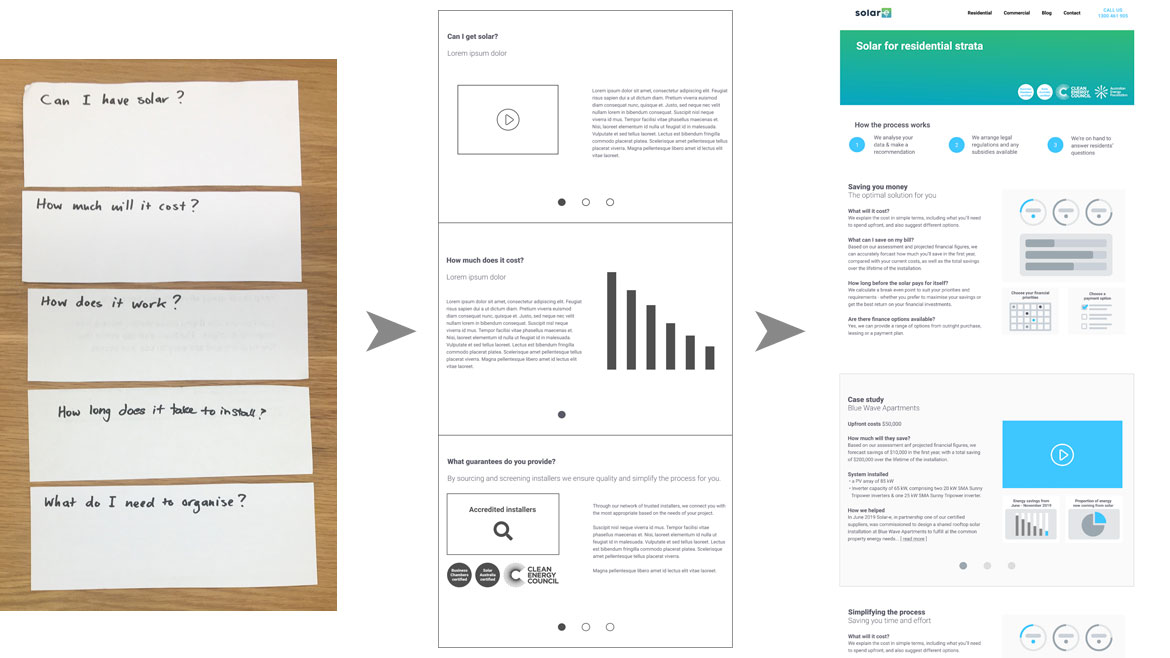

Combining the decision-making stages from the research with a customer journey map provided a framework to measure the current experience, and suggest where – and what – to improve for an ideal future experience.

Solar-e’s core strength is financial & statistical expertise. This meant they performed well in face-to-face consultations and detailed reports (the “research and consider” and “evaluate” stages of the customer journey), and this is where focused their efforts. Where they weren’t performing was in the earlier stages (“awareness” to “research and consider”) and the later stages (”installation” and ”post-installation”).

The journey map identified these earlier and later touchpoints as areas to focus on improving. It also provided a lens through which to see customer pain points and opportunities for solving them:

- creating awareness of the company

- updating the website to establish eligibility and credibility

- reducing effort by removing friction during installation

- post-installation services to reinforce trust

Development

UPDATING THE WEBSITE

The website is a key touchpoint. Interviewees mentioned how a 'professional-looking site' was a basic criterion for judging a supplier's credibility.

To learn how competitors address this pain point, I reviewed the websites of the top 12 Google-ranking “solar energy suppliers in Sydney”. I also made guerilla enquiries and requests for quotes to see what information they asked for, and how (and how quickly) they responded. I found confusing forms, long wait times and a lot of variation in the professionalism of their communications.

The review suggested simple features to add were case studies, warranties, accreditation and free resources & information about solar. Opportunities included offering a full end-to-end service, with professional, joined-up communication throughout the process.

SITE AUDIT

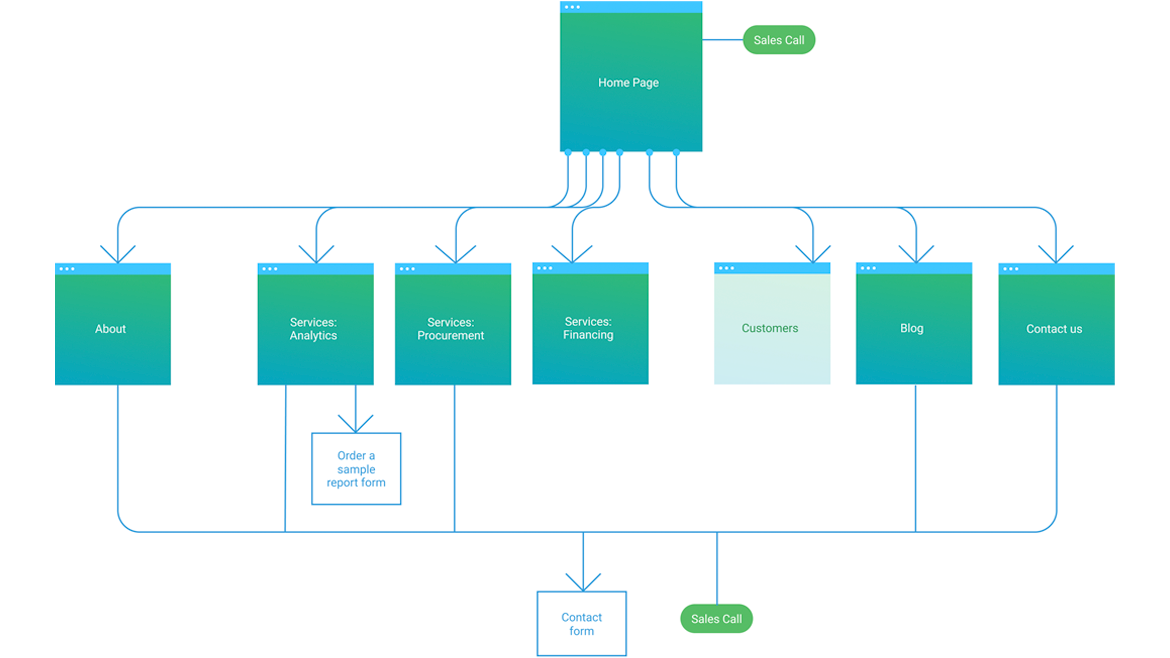

I audited the current Solar-e website against basic usability heuristics and found:

✗ broken links

✗ missing content ‘coming soon’

✗ mobile bugs

✗ unclear/inconsistent calls to action

INFORMATION ARCHITECTURE

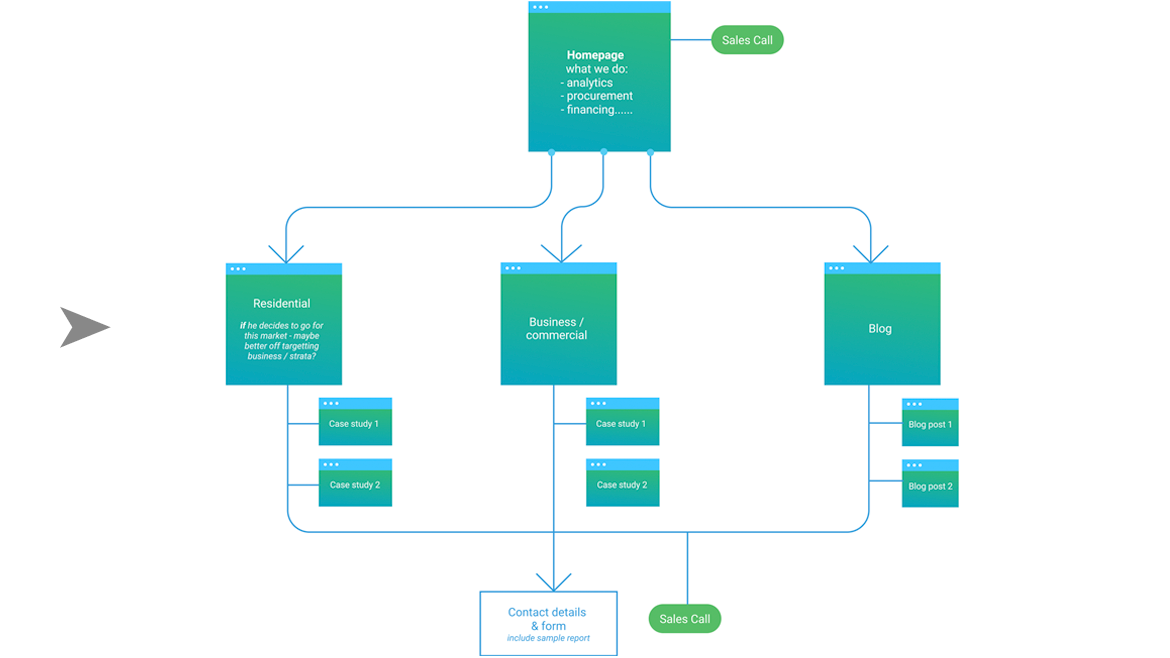

Usability testing suggested the website was confusing, with information repeated on multiple pages. There was also potential to restructure it by audience, rather than by products and services (although exact audience types would depend on whether Solar-e wanted to pursue strata as a whole or focus just on commercial strata).

CONTENT

Website content didn’t seem to match the quick information two of our three personas (the ”bottom-liner" and the "facilitator") need – instead, it assumed visitors were already further down the decision-making path.

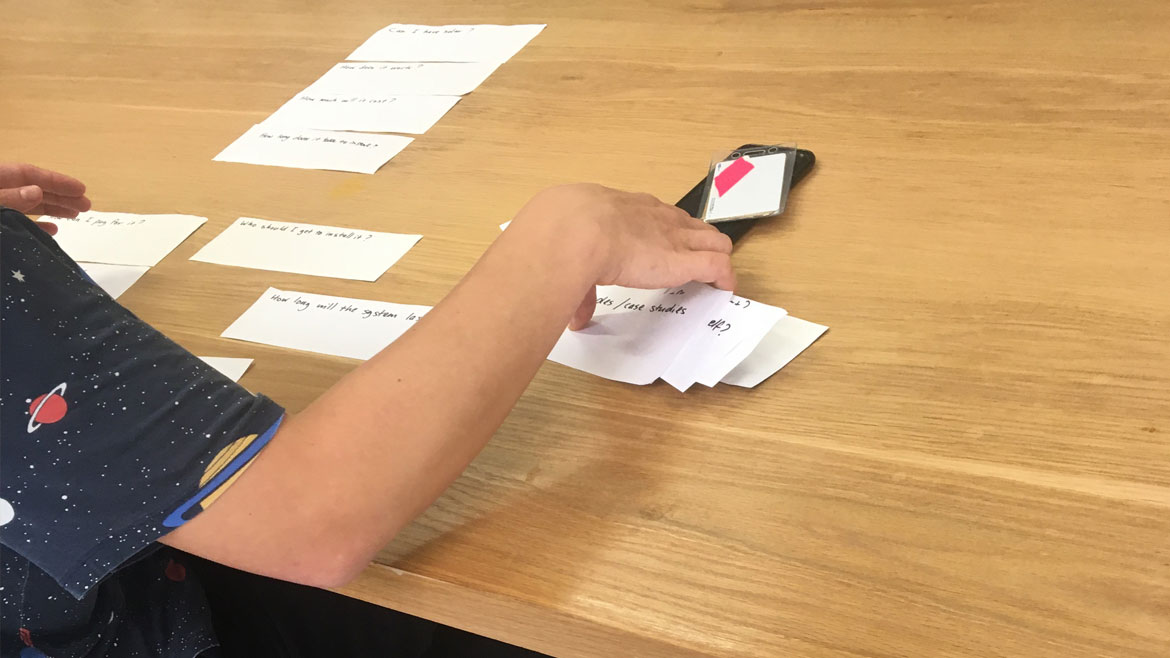

To test this hypothesis, I tried different content headings with six users to see what they prioritised. Paper prototyping reinforced the insight that content to establish or reinforce eligibility and credibility should feature most prominently.

REPORT QUICK FIXES

Solar-e saw the detail & customisation of their energy & financial reports as a key differentiator. However, our personas – and feedback from interviewees – found they could still be improved by:

- simplifying terminology

- leading with system options & financial projections

- providing a one-page summary

- making key insights & examples relevant to the audience.

CREATING A PACKAGE

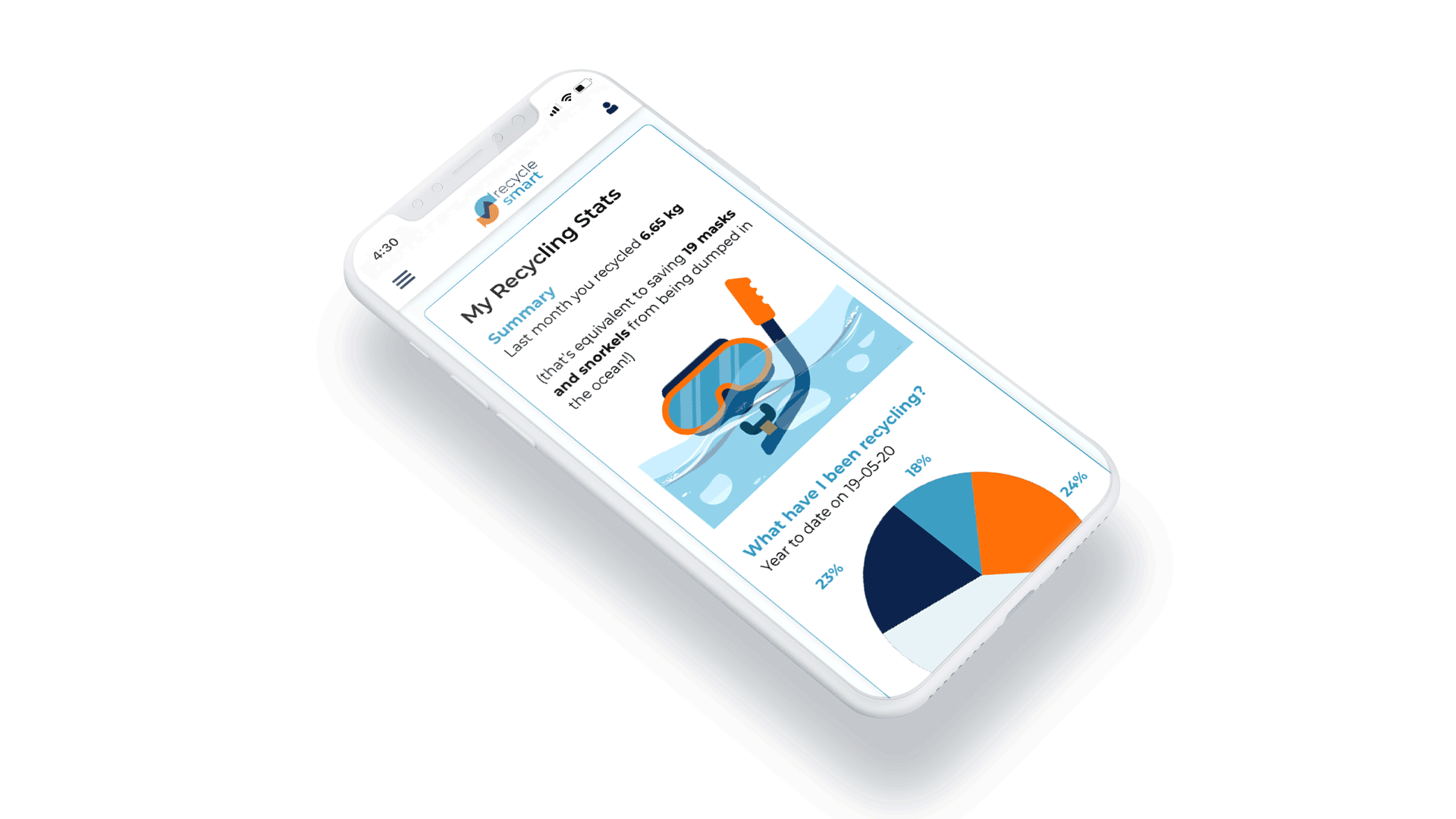

Finally, suggestions for bolt-on extras to reduce friction were

- Strata process package

Adding off-the-shelf legal templates and customised reports to reduce effort for strata managers - Post-installation monitoring

Adding existing white-label products to help reassure customers like the “bottom liner” and the “motivated investor” that the system they bought is performing as promised (this has the added benefit of generating case studies for future marketing).

Outcomes

Six months later Solar-e has put many of the recommendations in place:

- simplified reports

- updated web content highlighting end-to-end service

- regular blog entries and a case study “My 6-month post-installation review”

- logos of customers worked with, including NSW Business Chamber

- consistent posts & comments on renewable energy on LinkedIn

Reflections

Make the best use of those subjects you can reach — cold outreach to corporate customers was ineffective in the short time available. We used our own networks to speak to SME owners.

Informed assumptions can be a start — exploratory research suggested corporate and residential strata customers had similar needs, so we hypothesised that research with one group was analogous to the other.

Uncertainty is confusing, but also an opportunity — the business was in early development, so ‘backstage’ processes with leads and suppliers were unknown. However, that meant they were open to proposals for future direction.

Selected work